boulder co sales tax vehicle

The minimum combined 2022 sales tax rate for Boulder Colorado is 885. The December 2020 total local sales tax rate was 8845.

Used Vehicles Boulder Co Used Cars Suvs Trucks 62 In Stock

For information related to specific tax issues for state county or RTD please contact the State Department of Revenue at 303-238-7378.

. The Colorado sales tax rate is currently 29. The citys Sales Use Tax team manages business licensing sales tax use and other tax filings construction use tax reconciliation returns and various tax auditing functions. Electric Vehicle Registration Fee 5188.

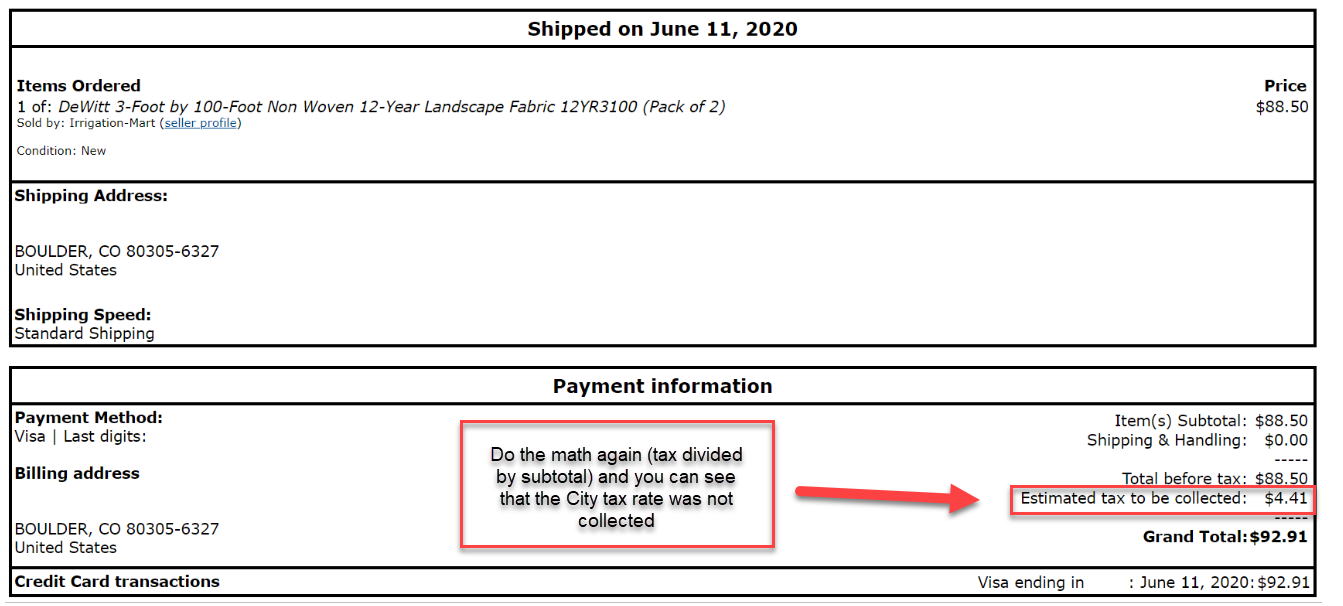

The current total local sales tax rate in Boulder CO is 4985. Use tax is levied in the following circumstances. The Sales Tax Return DR 0100 changed for the 2020 tax year and subsequent periods.

This is the total of state county and city sales tax rates. The rate is 29. Longmont Sales Tax Division 350 Kimbark St Longmont CO 80501.

The value of the tax credit is 35 of the vehicle purchase price or 50 of the vehicle conversion cost up to 7500 for vehicles with a gross vehicle weight rating GVWR up to 26000 pounds. There is a one-time processing fee of 25 which may be. However a county tax of up to 5 and a city or local tax of up to 8 can also be applicable in addition to the state.

You will have to pay sales tax on any private car sales in Colorado. 4000 Sales Tax or 3000 Use Tax. Commercial Electric Road Usage - 1000 to 16000 lbs 50.

Colorado collects a 29 state sales tax rate on the purchase of all vehicles. Interactive Tax Map Unlimited Use. Return the completed form in person 8-5 M-F or by mail.

Storing using or consuming in. Boulder CO Sales Tax Rate. For instance if you purchase a vehicle from a private party for 20000 then you will.

BOULDER COUNTY USE TAX For 2020 Boulder County collects use tax at the rate of 0985. Colorado Department of Revenue Sales Tax Division 303-238-7378 Boulder County Office of Financial Management Sales Use Tax 303-441-4519 Sales Tax Boulder Countys. Commercial Electric Road Usage - 16000 to 26000 lbs 100.

If the majority of the registered electors voting thereon vote for approval of this County-wide sales and use tax extension proposal revenues collected from the imposition of. Because the City of Boulder is home ruled and self. Sale Use Tax Topics.

13 rows Colorado Department of Revenue Sales Tax Division 303-238-7378 Boulder County Office of. 3460 Sales Tax or 3300 Use Tax See more. 3500 Sales Tax or 3000 Use Tax.

Motor vehicle dealerships should review the DR 0100 Changes for Dealerships document in addition. Motor Vehicles 1 Revised November 2021 Motor vehicles are tangible personal property and are therefore subject to Colorado sales and use taxes. Ad Lookup Sales Tax Rates For Free.

Used Jeep Cars For Sale In Boulder Co Cars Com

Certified Pre Owned Corwin Toyota Boulder

In Colorado Electric Cars Are Mostly For Rich People Could Federal And State Policy Change That Colorado Public Radio

Boulder Cost Of Living Boulder Co Living Expenses Guide

.jpg;w=960)

Boulder County Looks At Future Of Transportation Sales Tax The Longmont Leader

2926 Shady Holw W Boulder Co 80304 Redfin

Opinion Yes On 1c Boulder County Transportation Tax Is Crucial For Fighting Climate Change Boulder Beat

2017 Edition Trd Off Road Premium 4wd Toyota 4runner For Sale In Colorado Springs Co Cargurus

Should Boulder Do Away With Sales Tax On Groceries Boulder Beat

Boulder Chrysler Dodge Ram Boulder Co 80301 Car Dealership And Auto Financing Autotrader

Used Certified Loaner Vehicles For Sale In Colorado Boulder Nissan

Ncar Fire Boulder County Lifts Large Number Of Evacuations As Crews Attack Fire Overnight

Community Culture Resilience And Safety Tax City Of Boulder

Moving To Boulder Boulder Co Relocation Homebuyer Guide

Ford Dealership Boulder Interstate Ford

Subaru Certified Preowned Used For Sale In Boulder Colorado L Flatirons Subaru